inheritance tax rate kansas

Kansas does not have an estate tax or inheritance. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to.

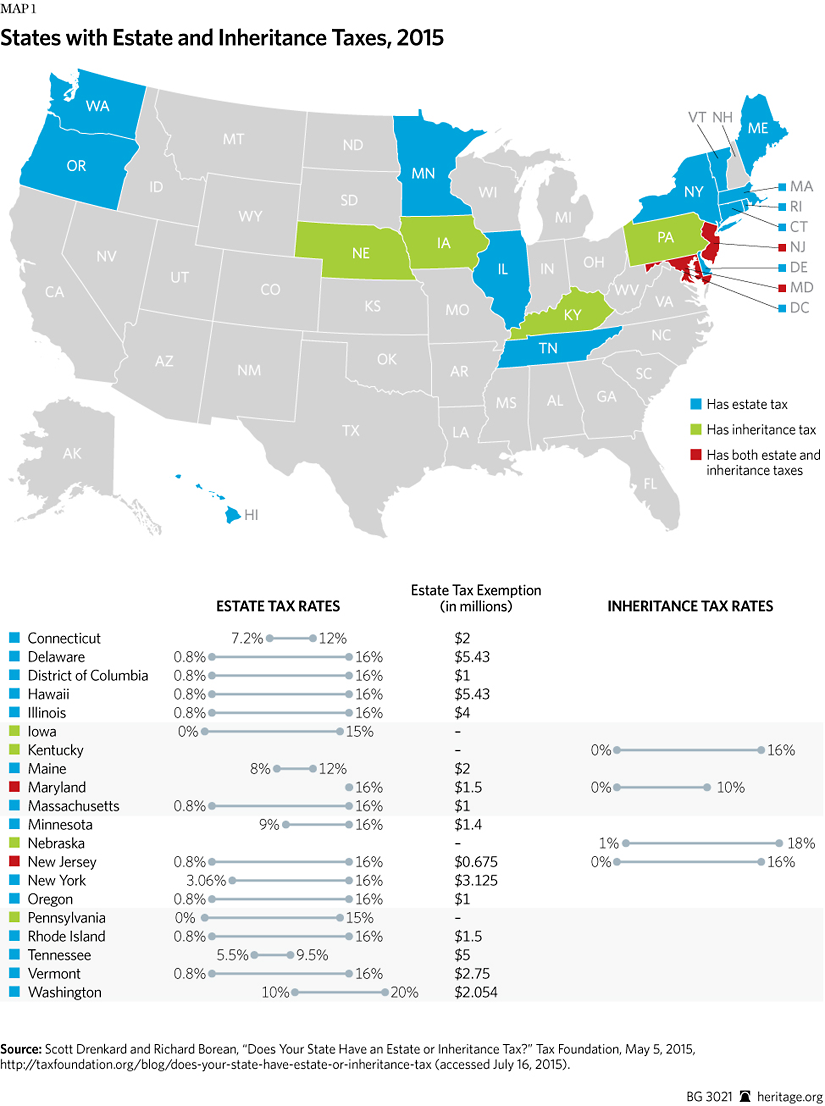

State Death Tax Is A Killer The Heritage Foundation

The kansas inheritance tax is based on the value of the.

. The surviving spouse and children are exempt from an inheritance tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

What if you die in 2018. There is no federal inheritance tax but there is a. These states have an inheritance tax.

The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax. Many cities and counties impose their own. The state income tax rates range from 0 to 57 and the sales tax rate is 65.

Your average tax rate is 1198 and your marginal tax rate is 22. The state sales tax rate is 65. Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000.

The maximum Maryland estate tax rate of 16 is not altered with the new legislation. This marginal tax rate. Below are the ranges of inheritance tax rates for each state in 2021.

The size of the inheritance. However 30 Kansas counties 105 Kansas cities and 400 Kansas townships impose a local intangibles tax on interest dividends and securities transactions but not wages. The standard Inheritance Tax rate is 40.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. As of 2021 the six states that charge an inheritance tax are. The sales tax rate in Kansas for tax year 2015 was 615 percent.

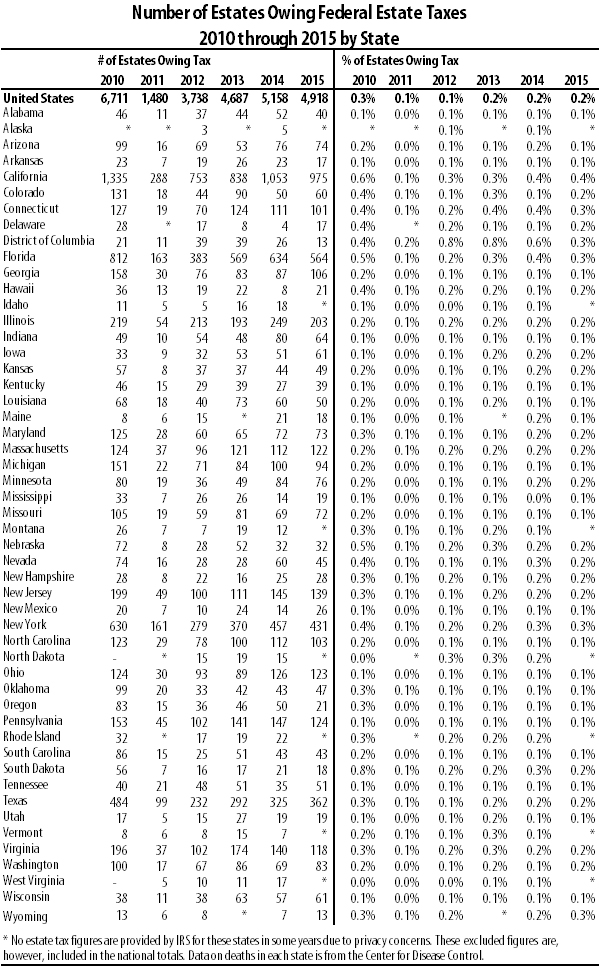

One both or neither could be a factor when someone dies. Estate tax is the amount thats taken out of someones estate upon their death. As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a.

The top inheritance tax. Home inheritance kansas rate tax. Inheritance tax rates differ by the state.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. The state income tax rates range from 0 to 57 and the sales tax rate is 65. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078.

The state sales tax rate is 65. The state has a progressive income tax with rates ranging from 310 to 570. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

Estate Taxes Are A Threat To Family Farms

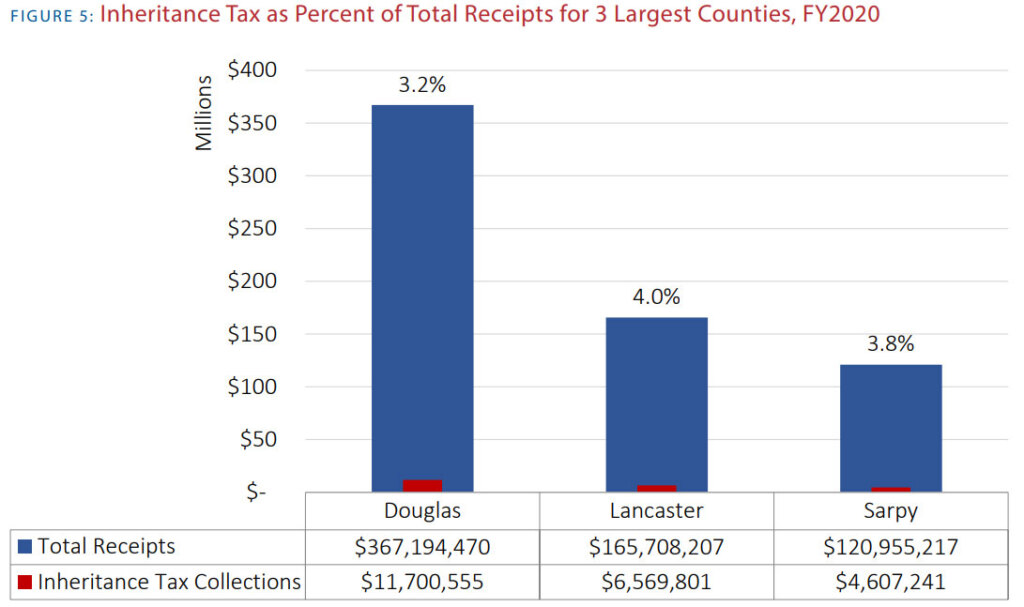

Death And Taxes Nebraska S Inheritance Tax

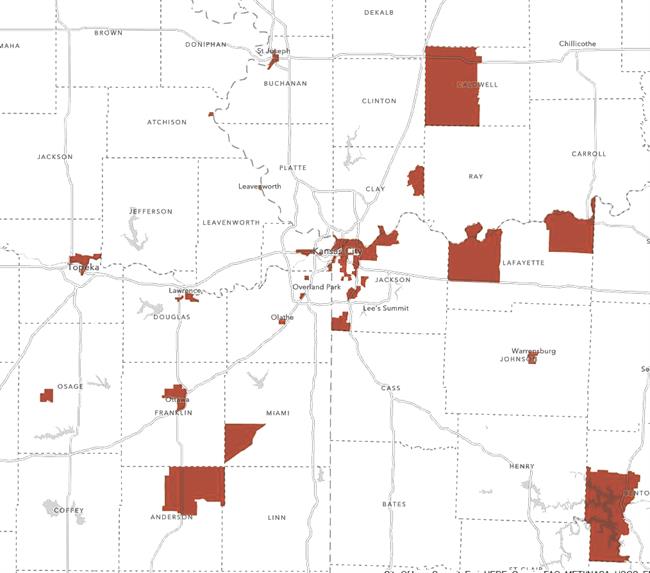

Everything You Need To Know About Missouri Tax Sale Process Kansas City Real Estate Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Estate Tax And Real Estate Eye On Housing

Does Kansas Charge An Inheritance Tax

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Kansas Reflector

Individual Income Taxes Urban Institute

Johnson County Kansas Homeowners May See 11 Property Value Increase

Kc Region Taxes Financial Incentives Profile Kcadc

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Kansas Retirement Tax Friendliness Smartasset

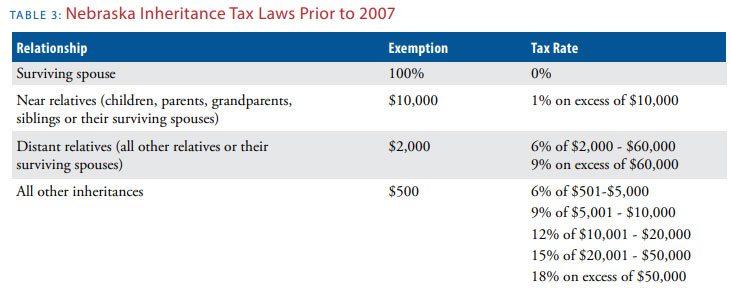

Death And Taxes Nebraska S Inheritance Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute